Homeownership on the Brink? An Unsustainable Trend Threatening Global Social and Economic Stability

Homeownership on the Brink? An Unsustainable Trend Threatening Social and Economic Stability

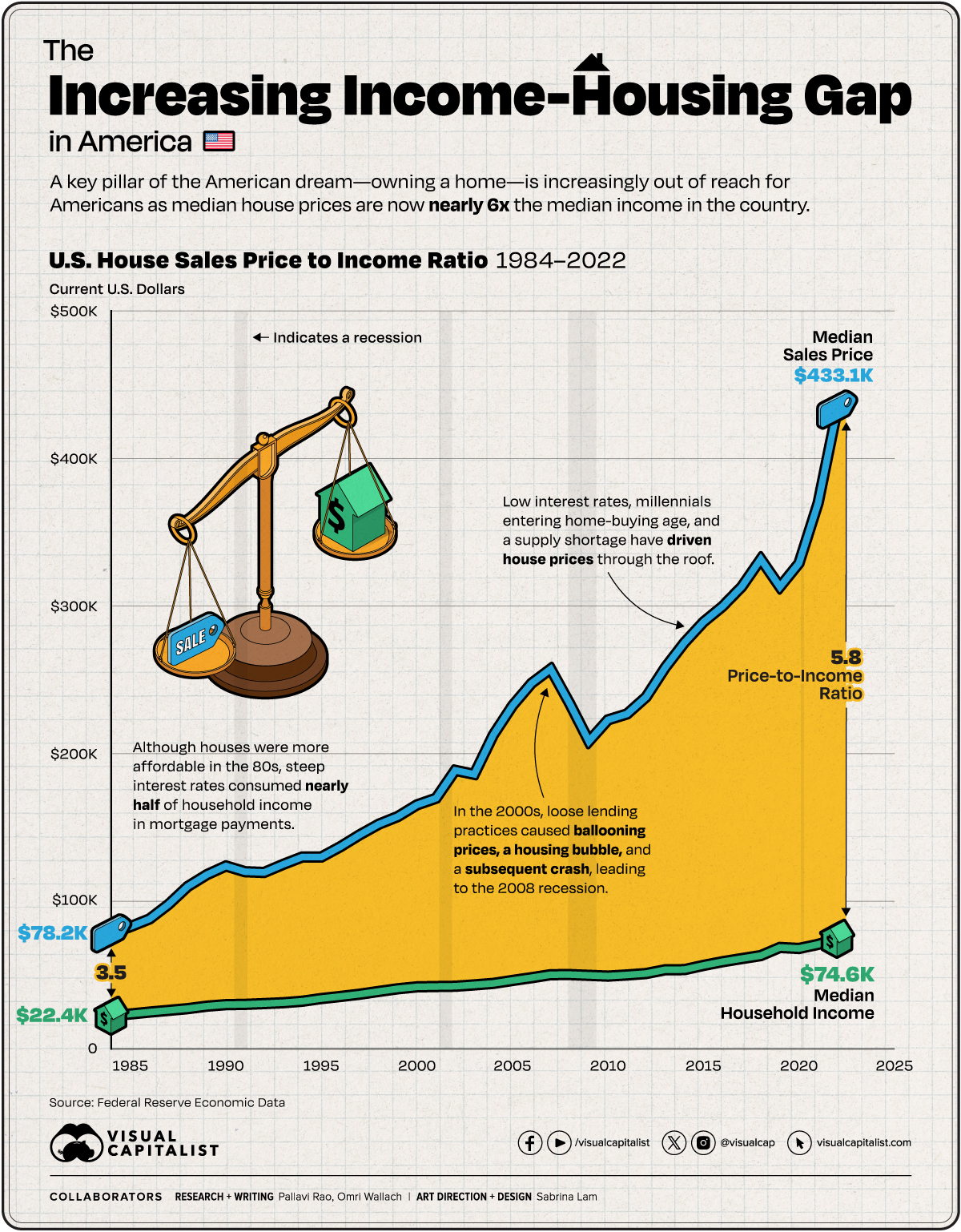

As we delve deeper into the housing crisis, it’s clear that homeownership in the U.S. is not just a personal aspiration—it’s becoming a precarious dream for many families. Since the initial report on the widening gap between median house prices and household income, the situation has only deteriorated. Rising prices and stagnant wages are now threatening both social as well as economic stability across the nation. This in turn threatens not just the domestic US but the world.

The Current Landscape

The data are alarming. Recent reports indicate that the median price of homes has soared to heights in proportion to US incomes at the worst ratio since the nations founding, with some markets seeing prices escalate to over seven times the median household income. For the average American, achieving homeownership feels increasingly out of reach. Historically sustainable cost to income ratios for housing are typically roughly 1/3 of income or less. In many urban centers, families now require an income of at least $120,000 just to afford a median-priced home, a stark contrast to the national median income, which hovers around $74,580.

The Price-to-Income Crisis

To illustrate the gravity of this situation, consider the price-to-income ratio, a crucial metric for assessing housing affordability. A ratio above 3 is typically considered a sign of potential housing market strain. Today, many metropolitan areas are exceeding ratios of 6 or even 7, indicating a severe affordability crisis. The implications are dire: families are forced to allocate a significant portion of their income to housing, leaving little room for savings, education, or other essential expenses. Few if any are willing or interested in working while not even being able to keep a roof above their heads let alone meet essential expenses. This results in feedbacks to the economy and businesses in many ways.

The Ripple Effects

When housing becomes unaffordable, the repercussions extend beyond individual families. Economic mobility is stifled; workers are less likely to relocate for better job opportunities if they cannot find affordable housing in their new locations. They are also more likely to leave areas in droves if costs compared to the pay for work in an area becomes prohibitive. This stagnation (and sometimes worse) contributes to labor shortages in many urban areas, as lower-wage workers simply cannot afford to live where some jobs are. At an income requirement now exceeding $120,000 for several major “economic hubs” just to have housing, a simple search of jobs as well as the actually advertised compensation available reveals that even “higher income” jobs are also likely at significant risk.

Moreover, the pressure on disposable income leads to decreased consumer spending—a vital engine of economic growth. Families stretched thin by housing costs often curtail expenditures on goods and services, which can contribute to economic slowdowns and significantly reduce or eliminate cushions that might be reserved for immediate crises. This cycle creates an environment ripe for extreme economic instability, threatening both local economies, the national landscape and the global economy.

The Broader Impact on Society

Homeownership is often seen as a cornerstone of the American Dream, symbolizing stability and prosperity. From the very foundation of the United States of America in 1776 it was a distinct competitive advantage for the US and its citizens. Often the tyrant King George the III and associates would try to seize land from colonists in the US despite being an ocean away. In those times land ownership was often reserved solely for lords and royals, yet arguably housing was still more accessible than it is at the moment. As the gap between wages and home prices widens, we risk extreme risks to the US and global economy. This disparity can foster discontent and deepen social divides, particularly among younger generations who are increasingly frustrated by their inability to have a roof over their head to call their own.

The consequences of an unaffordable housing market are not merely economic; they are social. Communities may face increased instability with higher rates of displacement, violence and homelessness.

Mobilizing for a Better Future

Addressing this crisis requires a multifaceted approach. Policymakers must prioritize affordable housing initiatives, such as increasing the supply of low-income housing, providing incentives for first-time homebuyers, and reforming zoning laws to encourage the development of diverse housing types. Additionally, financial literacy programs can empower buyers to navigate the complex landscape of mortgages and homeownership.

Those listing homes on our website with costs at 1/3 or less of median per capita after tax income in the economic area will be given priority to receive prominent features to our thousands of viewers.

As we stand on the brink of a homeownership crisis, it’s vital to recognize that the status quo is unsustainable. We must advocate for systemic change to ensure that the American Dream, a significant competitive advantage, remains within reach for future generations. Without decisive action, we risk not only the stability of the global economy but also the fabric of our society itself.

Chart Source: https://www.visualcapitalist.com/median-house-prices-vs-income-us/

Comments

There are no comments yet